硬盘驱动器市场蓬勃发展

Despite a poor second-quarter earnings performance from leading Hard Disk Drive (HDD) supplier Seagate Technology LLC, the overall HDD industry is continuing to thrive in 2008 due to an insatiable demand for low-cost, high-capacity storage devices, according to iSuppli Corp.

“Unlike the NAND flash chip industry, HDD vendors have been able to resist the worst impacts of the economic slowdown by learning how to control their costs,” said Krishna Chander, senior analyst for storage systems at iSuppli Corp. “The industry also has been aided by increased demand for more storage in PCs—as new applications demand increasingly larger-capacity HDDs. As long as demand for low-cost storage capacity keeps rising, the HDD industry will find ways to deliver.”

Double-digit shipment growth

In the first quarter of 2008, HDD vendors shipped 137 million units, up 21 percent on a year-on-year basis, with the bulk of the drives going to five segments: mobile computers, desktop PCs, consumer electronics, external drives and enterprise applications, i.e. both Serial Advanced Technology Attachment (SATA) and Serial Attached SCSI (SAS) drives.

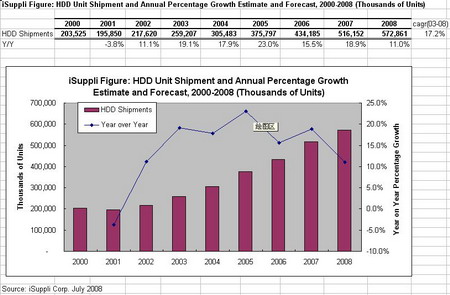

The attached figure presents unit shipments plus the year-on-year percentage growth forecast for the HDD industry for the period of 2000 through 2008.

HDD vendors reported healthy operating margins in the first quarter. Seagate Technology LLC reported $363 million in profits, or 11.7 percent of revenue, Western Digital Corp. announced $298 million, or a 14 percent return and Hitachi GST stated it had earned $65 million, or 4.6 percent of revenue. For Hitachi GST, this was a desirable outcome after many quarters of being in the red.

All six major vendors are expecting the industry to continue to increase shipments in 2008. iSuppli forecasts second-quarter shipments will be up by 16 percent compared to 2007.

Seagate’s struggles

“It’s noteworthy that the U.S. recession did not have a material impact on the HDD industry during the last two quarters,” Chander said. “Seagate’s second-quarter net income did come in lower than expected, but this was not because of any decline in demand, but rather due to lower prices for its products. The company’s shipments of HDDs for the fast-growing notebook PC segment were relatively low compared to sales of desktop-PC drive shipments. With notebook PC HDDs priced higher than those for desktops, Seagate’s income was negatively impacted. The company already is working to remedy this situation.”

The road to recovery

The HDD industry has overcome major upheavals and faced down doomsday predictions before—and is likely to do so again.

Throughout the history of the HDD business, shipments have increased by double-digit percentages every year, except for the disastrous period of 2001, when they suffered negative growth. Within a year, HDD shipments recovered and the technology entered the consumer-electronics field with applications such as the Apple iPod, other personal media players and set-top boxes.

But the HDD industry soon faced a new challenge: highly price-competitive NAND flash memory, which vied with HDDs for design wins in the consumer-electronics field. Small-form-factor HDDs for such applications were quickly eliminated. However, the HDD stayed one step ahead of the NAND flash competition in other consumer electronics devices by focusing on higher-capacity drives.

NAND-type flash continued to make inroads in the computer segment as well, where it was used for solid-state drives. There too, the hard drive industry learned to survive by adopting portions of NAND flash in its HDDs—called Hybrid Hard Drives or HHDs. The HDD industry has transitioned to Perpendicular Magnetic Recording, which has helped it increase area density at a healthy 40 percent Compound Annual Growth Rate (CAGR).

From 2003 to 2008, HDD industry shipments grew at an astounding CAGR of 17.2 percent.

No hard times for hard drives

HDD shipments have been rising since 2001 at double-digit rates, and despite the challenges of the last few years, demand for drives has not begun to dry up. As long as consumers think in terms of terabytes of storage, there is a great potential for the HDD industry to keep meeting these demands.

For more information, please contact:

Jonathan Cassell

Editorial Director and Manager, Public Relations

iSuppli Corporation

Office: 408.654.1714

Mobile: 408.921.3754