DRAM供应商第二季度兴衰

Facing a tough market following months of losses, the second quarter of 2008 was tumultuous for the Top-10 DRAM suppliers as a mixture of poor profits was coupled with sequential megabyte unit growth, according to iSuppli Corp.

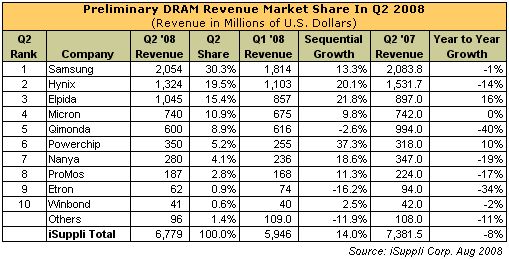

Samsung maintained its No. 1 position in the DRAM market with more than 30 percent market share recorded during the second quarter of 2008 while Qimonda’s position dropped to just 9 percent market share during the quarter.

Qimonda, which captured 16 percent market share just two years ago, has now lost 7 percent of that growth as other DRAM suppliers have forged ahead.

The attached figure presents the second quarter market share results for the Top-10 DRAM suppliers according to iSuppli’s latest forecasts.

Still growing

One of the more noticeable developments coming from suppliers’ Q2 results is that the industry unit growth has not slowed down, at least, not yet.

“The industry megabyte bit growth grew by a stunning 17 percent sequentially during the second quarter, blowing iSuppli’s forecast of 10 percent,” said Nam Hyung Kim, director and chief analyst for memory ICs/storage systems at iSuppli. “The unit growth doesn’t seem to be slowing down either and is even higher than that of the first quarter. The positive side is that the PC market has been sound. However, oversupply may be inevitable in the third quarter due to OEMs’ aggressive inventory build-up during the second quarter”

Elpida’schase

Although Hynix grew its DRAM sales by 20 percent, Elpida increased its sales by 22 percent, keeping a market share distance of 4 percentage points between two. Hynix gained nearly 20 percent of the market while Elpida’s market share increased to more than 15 percent during the quarter.

Elpida, along with its foundry partner Powerchip, increased its megabyte unit explosively by 26 percent and 38 percent, respectively. “The market share battle between Hynix and Elpida could delay the market recovery,” Kim noted. “Elpida clearly wants to be No. 2 soon while Hynix will try to reduce its NAND growth and to increase DRAM production to retain its market share.”

Near Term DRAM warning

But all of the DRAM suppliers could face turbulent times ahead as after experiencing a mild recovery in the second quarter, the global DRAM market is showing renewed signs of weakness, with prices expected to fall during the third quarter due to bloated inventories, according to iSuppli.

After iSuppli upgraded its rating of near-term conditions for DRAM suppliers to “Neutral,” up from “Negative” on April 25, the market bottomed out and manufacturers’ profitability improved during the second quarter. Following months of losses, a few top-tier suppliers managed to attain profitability starting in June and a handful are expected to do so in the third quarter.

However, the market is showing renewed warning signs, with OEM contract prices for DRAM likely to decline in August and September. The main question now facing the industry is how much prices will decline during the third quarter. We believe it will be over 10 percent from current level.

For more information, please contact:

Jonathan Cassell

Editorial Director and Manager, Public Relations

iSuppliCorporation

Office: 408.654.1714

Mobile: 408.921.3754